Are you a fashion lover who wants to stay trendy without the immediate financial burden? This guide to “buy now pay later shoes no credit check” will lead you through the best options available.

Understanding Buy Now Pay Later (BNPL)

Buy Now Pay Later (BNPL) is a financial service that allows consumers to purchase items immediately and pay for them over time, often with little to no credit check required. This has gained popularity in various sectors, including footwear, where consumers can enjoy trendy shoes without draining their bank accounts upfront.

According to a study by Forbes, the BNPL market has grown significantly, with 60% of U.S. consumers using this payment option. This growing trend is especially relevant in the footwear industry, where consumers often seek the latest styles without impacting their financial stability.

Benefits of No Credit Check BNPL Programs

Accessibility for All

No credit check programs open the door for individuals who may not qualify for traditional credit options. This means that even those with poor or no credit histories can enjoy fashionable footwear without worrying about a credit score.

Flexible Payment Plans

Many BNPL services offer flexible payment plans. Shoppers can choose payment schedules that fit their budget, often allowing for installment payments over a few weeks or months. This flexibility helps consumers manage their finances better.

Immediate Ownership

With BNPL, shoppers can wear their new shoes right away instead of waiting until they have saved enough money to make the purchase. This immediate ownership can be a game-changer for those wanting to keep up with the latest fashion trends.

| Benefit | Description |

|---|---|

| Accessibility | No credit checks allow anyone to participate. |

| Flexibility | Various payment plans cater to different budgets. |

| Immediate Access | Wear your shoes immediately without pre-payment. |

Real-World Footwear Experiences with BNPL

Let’s dive into some real-world experiences of customers who opted for BNPL services when buying shoes.

Case Study 1: Sarah’s Trendy Sneakers

Sarah, a college student, wanted to buy a pair of trendy sneakers for her casual outfit, but her budget was tight. She found a BNPL service that allowed her to secure her favorite sneakers, priced at $100, with a payment plan that spread the cost over five weeks.

“I loved the shoes and didn’t want to miss out,” Sarah said. “Using BNPL meant I could buy the shoes I wanted without stressing my finances.”

Case Study 2: Jason’s Work Boots

Jason, a construction worker, needed durable work boots but couldn’t afford the full price upfront. He turned to a footwear retailer offering BNPL with no credit check.

“This option was perfect for me,” Jason shared. “I could get the boots I needed to work now and pay for them later, which is a lifesaver.”

How to Choose the Right BNPL Service for Shoes

1. Research Available Options

Before choosing a BNPL service, it’s essential to research various options. Look for retailers that offer footwear through BNPL and check their policies regarding payment plans and fees.

2. Consider Payment Flexibility

Different BNPL services offer varying levels of payment flexibility. Some allow weekly installments, while others may provide monthly payments. Choose the one that aligns with your financial situation.

3. Read Reviews

Consumer reviews can provide insight into the reliability and customer service of a BNPL provider. Look for testimonials from other footwear shoppers to gauge their experiences.

Comparison of Popular BNPL Services for Footwear

| BNPL Service | Payment Terms | Available Retailers | No Credit Check? |

|---|---|---|---|

| Affirm | Monthly installments | Various retailers | Yes |

| Klarna | Pay in 4 installments | Selected brands | Yes |

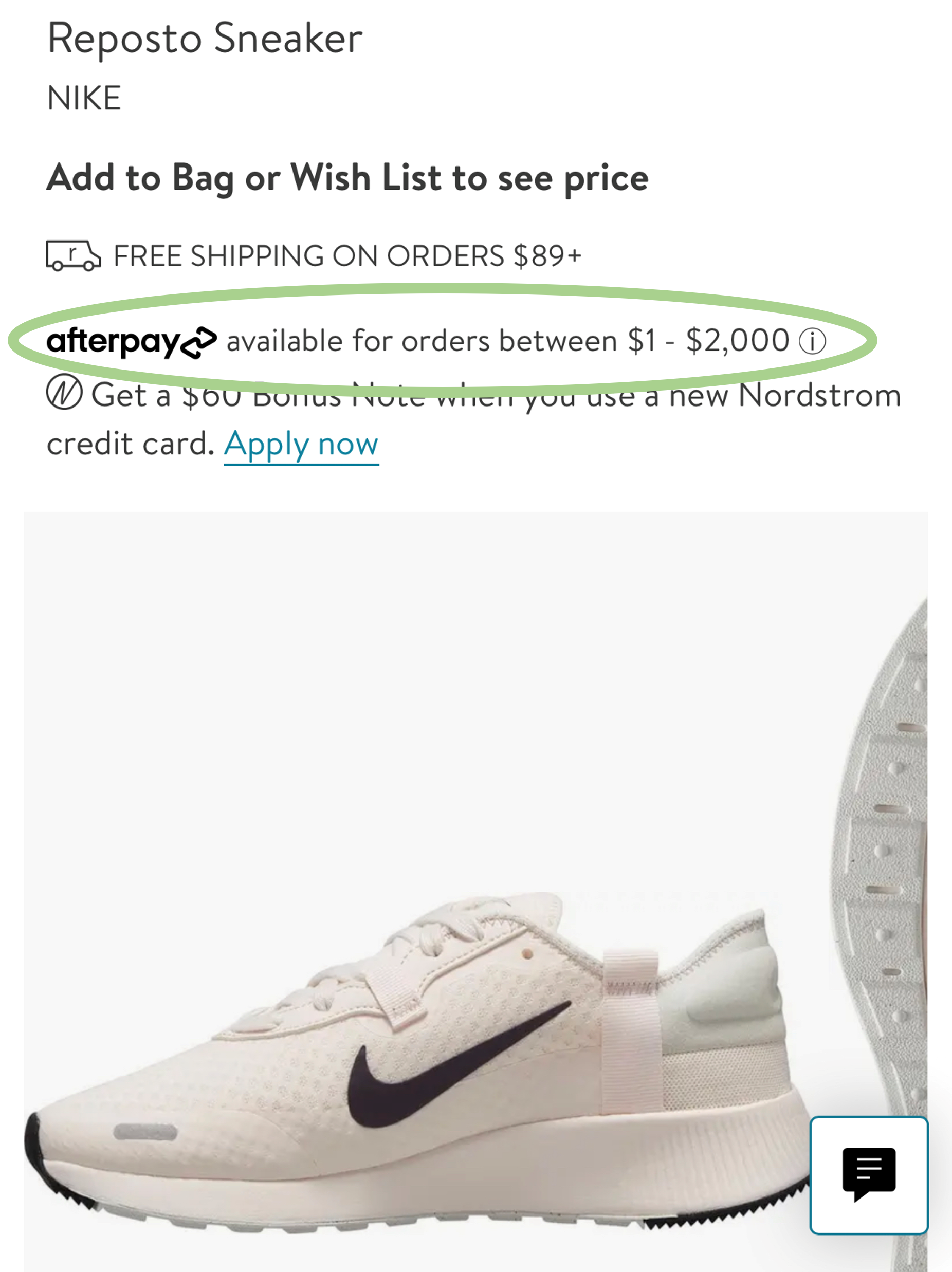

| Afterpay | Pay in 4 interest-free installments | Wide range of online stores | Yes |

| Sezzle | Pay in 4 installments, options for rescheduling | Participating merchants | Yes |

Tips for Using BNPL Responsibly

1. Set a Budget

Before using BNPL services, set a budget for how much you can afford to spend. This will help you avoid overspending and subsequent financial stress.

2. Be Aware of Fees

Some BNPL services may charge late fees or interest if you miss a payment. Familiarize yourself with the terms to avoid unexpected charges.

3. Stick to Your Payment Schedule

Make it a priority to pay on time. Keeping to your payment schedule can improve your financial health and avoid potential negative consequences.

Pros and Cons of Buy Now Pay Later Shoes

Pros

- Immediate access to trendy footwear

- No upfront payment pressure

- Flexible payment options

- Helps build a positive payment history

Cons

- Potential for overspending

- Late fees if payments are missed

- Interest rates can apply in some cases

- Dependency on credit services

Frequently Asked Questions (FAQs)

1. What is the best BNPL service for shoes?

The best BNPL service depends on your needs and preferences. Services like Afterpay and Klarna are popular for footwear purchases due to their user-friendly platforms and wide retailer accessibility.

2. Will my identity be verified when using BNPL?

While many BNPL services perform minimal identity verification, most do not conduct a stringent credit check, making it accessible for those with poor credit.

3. How do I make payments for my BNPL shoes?

Payments can be made through the BNPL service’s app or website. Most services allow you to manage your payment schedule easily and set reminders.

4. Can I return shoes purchased with BNPL?

Yes, you can return shoes purchased through BNPL. However, be aware of the refund policy of the retailer, as it can affect your payment obligations.

5. Are there any fees associated with BNPL services?

Some BNPL services may charge late fees if you miss a payment. Always read the terms and conditions to understand any possible charges.

6. Is BNPL safe to use?

Generally, BNPL services are safe to use if you choose reputable providers. Look for customer reviews and ensure that the service has secure payment options.

7. Can I use BNPL for online shoe purchases?

Yes, many online retailers accept BNPL services, making it convenient to shop for shoes without immediate payment.

8. Will using BNPL hurt my credit score?

Using BNPL services typically does not impact your credit score since they do not conduct hard credit checks. However, missed payments can negatively affect your financial reputation.

9. How do I find retailers that accept BNPL?

You can find retailers that accept BNPL services by visiting the BNPL service’s website or checking with popular footwear merchants directly on their checkout pages.

10. How can I cancel a BNPL plan for shoes?

To cancel a BNPL plan for shoes, you generally need to log into your account on the BNPL service’s platform and follow their cancellation process. Be mindful of any return policies from the retailer.

Conclusion: Step into Style with BNPL Options

Buy Now Pay Later services for shoes without credit checks provide a unique opportunity for shoe enthusiasts to stay stylish without immediate financial burden. With the flexibility of payment plans, accessibility, and the immediate thrill of new footwear, it’s no wonder this trend continues to grow.

As you explore your options, keep in mind the importance of responsible spending. By making informed choices and sticking to your budgets, you can enjoy fashionable footwear while maintaining financial health.

So why wait? Embrace the convenience of BNPL for your next shoe purchase and step out in style!