In a world where fashion meets functionality, shoes are not just about comfort; they are a representation of personal style, identity, and sometimes, status. However, the cost of footwear can be daunting, especially for those who want the latest styles without the immediate financial burden. This is where payment plans come into play. In this article, we will explore everything you need to know about buying shoes on a payment plan, including options, benefits, challenges, and tips.

What is a Payment Plan?

A payment plan is a financial arrangement that allows consumers to purchase products or services and pay for them over time rather than all at once. In the footwear market, shopping on a payment plan can make high-end shoes more accessible to a broader audience. This section will delve into how these plans work and why they are beneficial for shoe lovers across the USA.

How Payment Plans Work

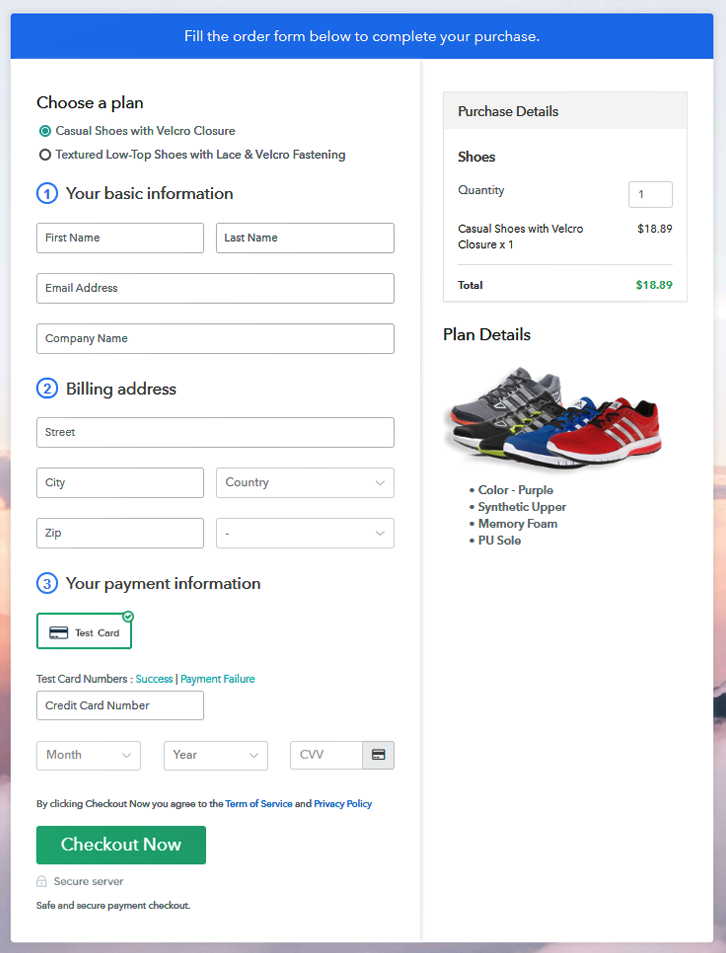

Typically, you can enter into a payment plan at the point of sale. Retailers often provide options through third-party services or in-house financing. Here’s how it usually works:

- Choose your desired shoes and proceed to checkout.

- Select the payment plan option at checkout, where the total price is divided into smaller, manageable installments.

- Provide necessary information, such as payment method and personal identification.

- Make an initial payment followed by subsequent payments over the duration of the plan, which can range from a few weeks to several months.

Types of Payment Plans

There are primarily two types of payment plans:

- Buy Now, Pay Later (BNPL): This allows consumers to make a purchase and pay for it in fixed installments, typically without interest.

- Financing Through Credit: Long-term financing options often come with interest rates and more stringent credit checks.

The Benefits of Buying Shoes on Payment Plans

Purchasing shoes on a payment plan offers a myriad of advantages. Here’s a closer look at some of the key benefits that can make your shopping experience more enjoyable:

Affordability

One of the most significant advantages of payment plans is affordability. Instead of paying a lump sum upfront, you can spread the cost over several weeks or months, making it easier to budget for high-quality footwear.

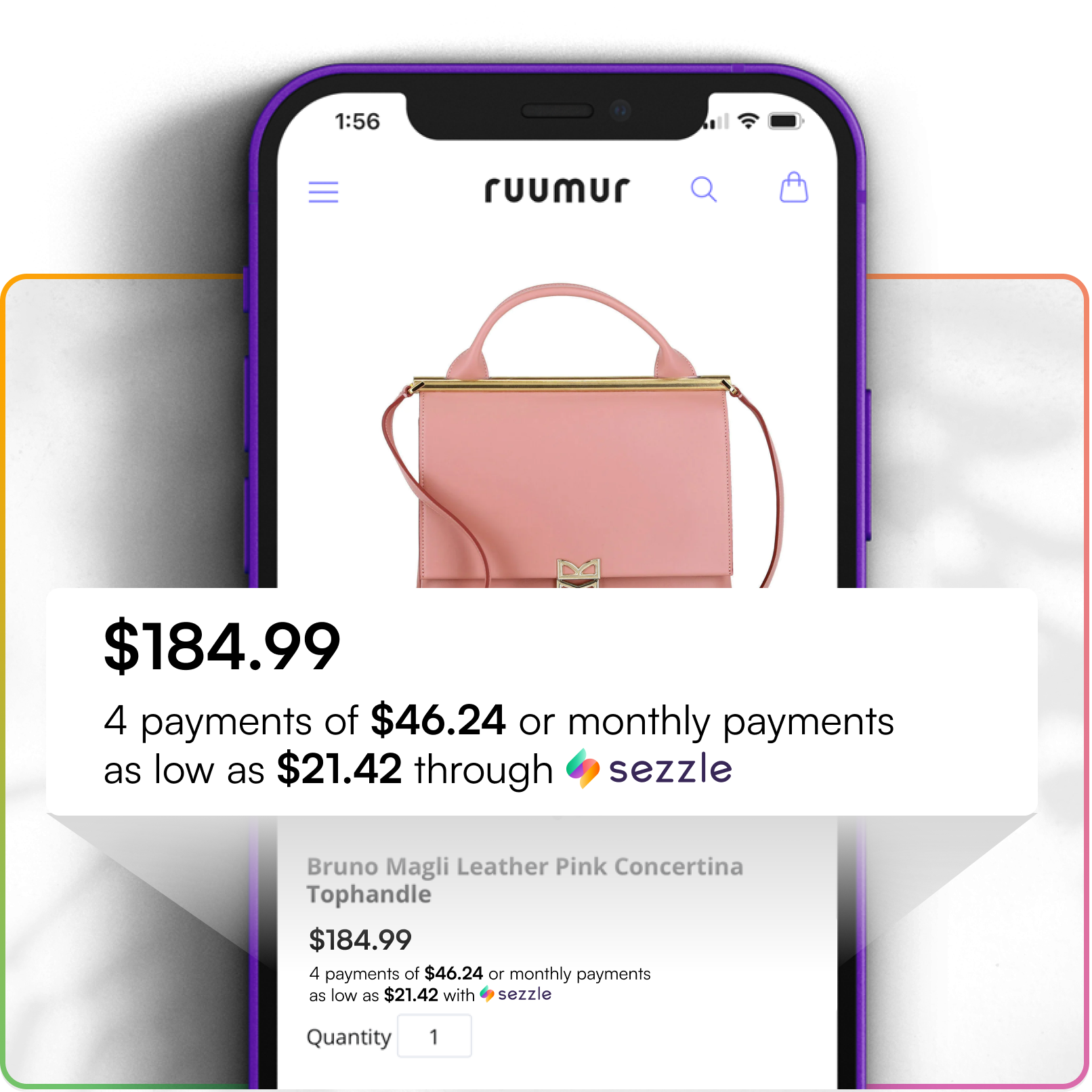

Access to Premium Brands

Payment plans also enable consumers to access premium or designer shoe brands that might otherwise be out of reach. For instance, brands like Nike, Adidas, and Gucci frequently come with a hefty price tag. A payment plan allows you to enjoy these luxury items without breaking the bank.

Flexibility

Many payment plans offer flexible payment schedules. This means you can choose the frequency and amount of your payments, which can help align with your financial situation.

Building Credit

If you choose a financing option that reports to credit bureaus, successfully making your payments can help build your credit score over time, thus improving your financial standing.

Challenges and Things to Consider

While payment plans come with benefits, there are challenges as well. It’s essential to weigh these factors against the advantages:

Interest Rates and Fees

Some payment plans may include interest or hidden fees, which can add to the total cost of the shoes. It’s crucial to read the fine print before committing to a plan.

Impact on Credit Score

Not all payment plans report to credit bureaus, but if you miss payments, it can negatively impact your credit score. Always stay informed about the terms of your agreement.

Impulse Buying

Payment plans might encourage impulse buying, leading to unaffordable purchases. It’s essential to stick to your budget and only buy what you need.

Top Brands Offering Payment Plans for Shoes

Many popular shoe brands and retailers in the USA have recognized the need for flexible payment options. Here are some of the leading options:

| Brand | Payment Plan Options | Interest Rate | Pros | Cons |

|---|---|---|---|---|

| Nike | Afterpay, Klarna | 0% (if paid on time) | Wide selection, reputable brand | High-demand products may sell out |

| Adidas | PayPal Credit | Variable APR | Quality performance shoes | Potential interest charges |

| DSW | Affirm | 0%-30% | Frequent sales and discounts | Limited brand selection on sales |

| Foot Locker | Afterpay, Klarna | 0% (if paid on time) | Large inventory, popular styles | Fees for late payments |

| Zappos | Affirm | 10%-30% | Excellent customer service | Shipping fees may apply |

Successful Case Studies of Footwear Enthusiasts Using Payment Plans

To further illustrate the benefits of payment plans, let’s look at some real-world footwear experiences from U.S. customers:

Case Study 1: The Busy Professional

Jessica, a busy marketing executive, needed a pair of formal shoes for her new job but was hesitant to spend over $200 upfront. By choosing a payment plan with Zappos, she secured a stunning pair of heels and paid in four easy installments. Jessica appreciated the flexibility and ended up loving the shoes, which she later wore to important meetings.

Case Study 2: The College Student

Mark, a college student passionate about sneaker culture, wanted to buy a limited-edition Nike pair. However, with a tight budget, he opted for Afterpay. By breaking down the costs into smaller payments, Mark could still enjoy his hobby without compromising his monthly expenses. He said, “Payment plans have made it easier for me to keep my shoe game strong while managing my finances.”

Case Study 3: The Fashion-forward Parent

Linda, a mother of two, often faces high costs when shopping for her kids’ shoes. Using Klarna, she managed to buy both school and sports shoes without stressing her budget. She appreciated that she could purchase quality footwear that would last but still manage her monthly finances with the flexibility provided by the payment plan.

Comparison of Payment Plan Services

When considering a payment plan, it’s crucial to compare the available options. Below is a comparison of some popular services:

| Service | Payment Duration | APR | Late Fee | Pros |

|---|---|---|---|---|

| Afterpay | 4 installments, bi-weekly | 0% | $8 | No interest, easy setup |

| Klarna | 4 installments, bi-weekly | 0% (finance later options available) | $7 | Flexible payment options |

| Affirm | 3-36 months | 10%-30% | $25 | Longer payment duration |

| PayPal Credit | Varies | Variable APR | $35 | Widely accepted |

Tips for Shopping Shoes on Payment Plans

Here are some useful tips to consider when shopping for shoes using payment plans:

1. Research Brands

Before committing, do your research on the brands that offer the best payment plans and select those that align with your style and budget.

2. Read the Fine Print

Always read the terms and conditions associated with payment plans to avoid surprises, such as hidden fees or interest rates.

3. Stay Within Your Budget

Stick to a budget and only purchase what you can afford to pay back within the designated payment schedule.

4. Monitor Your Payments

Keep track of your payment schedules and ensure that you make payments on time to avoid late fees and negative impacts on your credit score.

FAQs on Buying Shoes on Payment Plans

1. What types of payment plans are available for buying shoes?

The most common types of payment plans include Buy Now, Pay Later (BNPL) and financing through credit.

2. Are there any fees associated with payment plans?

Some payment plans may include late fees or interest, so it’s essential to review the terms before agreeing.

3. Can I buy shoes on a payment plan with bad credit?

Some payment plan services may have lenient approval processes, but it varies depending on the provider.

4. How do I choose the best payment plan?

Look for options that offer 0% interest rates, flexible payment durations, and favorable terms that suit your financial situation.

5. Are there any penalties for late payments?

Many payment plans impose late fees for missed payments, which can vary depending on the provider.

6. Can I return shoes I bought on a payment plan?

Most retailers allow returns, but you must follow the specific return policy outlined by the retailer and the payment plan provider.

7. Do payment plans affect my credit score?

Payment plans that report to credit bureaus can affect your credit score, either positively or negatively, depending on your payment behavior.

8. How can I find stores that offer payment plans for shoes?

Many major retailers and online shoe stores offer payment plans; check their website or inquire at the store.

9. Can I use a payment plan for clearance items?

It depends on the retailer’s policy; many allow payment plans on clearance items, but it’s best to check their terms.

10. What happens if I cannot make a payment?

Failure to make a payment can result in late fees and potential negative impacts on your credit score.

Conclusion

Buying shoes on a payment plan can open the doorway to stylish, high-quality footwear without the immediate financial burden. With numerous brands and flexible payment options, it’s now easier than ever for shoe enthusiasts in the USA to keep their collections fresh and fashionable. Whether you’re looking for the latest sneakers, stylish boots, or elegant dress shoes, don’t hesitate to explore the many payment plan options available to you. Remember to research, budget wisely, and enjoy the experience of stepping out in style!

For authoritative information on financial options, you can visit Consumer Financial Protection Bureau.