Are you tired of waiting to buy that perfect pair of shoes? The footwear industry has evolved, offering exciting options like “Buy Now Pay Later” (BNPL) schemes. This article is your comprehensive guide to understanding and navigating the world of buy now pay later shoes online. Perfect for fashion lovers, professionals, and business owners, we explore real-world experiences, comparison tables, pros and cons, FAQs, and much more!

What is Buy Now Pay Later (BNPL)?

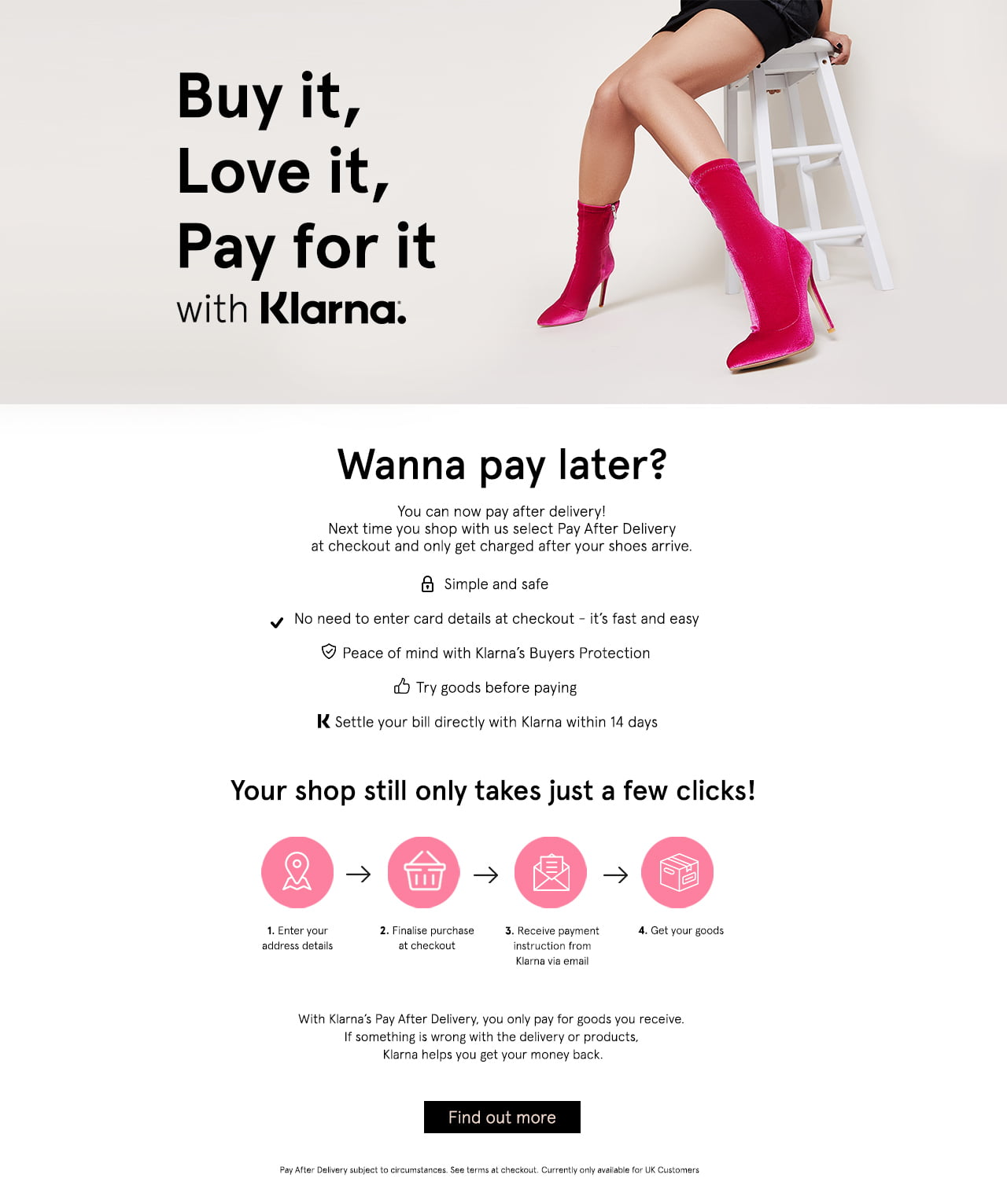

“Buy Now Pay Later” is a payment method that allows customers to purchase goods immediately and defer payment for a later date, often in installments. This service has gained popularity in the footwear niche, facilitating a more flexible shopping experience. Brands like Klarna, Afterpay, and Affirm have made it easy to integrate BNPL options into the checkout process.

Understanding the Mechanism of BNPL

When you choose to pay using BNPL, you can divide your total purchase amount into smaller payments, typically spread over several weeks or months. This is especially beneficial for higher-priced items, making it easier to budget without sacrificing style or comfort.

How BNPL Works for Shoes Online

Here’s a step-by-step breakdown of how to buy shoes online using BNPL:

- Shop for your desired shoes on an e-commerce platform that offers BNPL.

- Select the BNPL option at checkout.

- Complete the necessary information for approval, including basic personal details and payment methods.

- Receive instant approval or denial of your application.

- If approved, make your initial payment and receive your shoes right away!

- Pay off the remaining balance in installments as per the agreed schedule.

The Benefits of Buying Shoes with BNPL

Choosing to use BNPL for your footwear purchases comes with numerous advantages that can enhance your shopping experience. Here are some key benefits:

1. Immediate Access to Quality Footwear

With BNPL, you can wear your new shoes right away without the full financial commitment upfront. This immediate gratification can be vital for fashion enthusiasts who want to elevate their style for special occasions or events.

2. Budget-Friendly Payments

Instead of making a single large payment, BNPL spreads the cost over manageable installments. This is particularly advantageous for individuals who are on a tight budget or those who prefer to keep their finances flexible.

3. Enhanced Shopping Experience

Many retailers that offer BNPL also provide user-friendly online experiences, such as seamless navigation and customer service. This enhances your overall shopping experience, making it easier to find the perfect pair of shoes.

4. No Interest Fees (if Paid on Time)

In many cases, if you pay off your balance within the agreed period, there are no added interest fees. This can make BNPL an appealing alternative to traditional credit cards, which often come with higher interest rates.

Real-World Footwear Experiences: Testimonials and Case Studies

Understanding the real-world implications of BNPL can give you valuable insights. Here are two case studies from customers who used BNPL to purchase shoes.

Case Study 1: Sarah’s Wedding Shoes

Sarah, a bride-to-be, needed a stunning pair of heels for her wedding. After browsing online, she found her dream shoes priced at $250. Instead of waiting weeks to save up, she opted for BNPL through her favorite online retailer. By splitting the payment into four installments of $62.50, she secured the shoes right away without straining her budget. Sarah confidently walked down the aisle, crediting the BNPL option for her stress-free shopping experience.

Case Study 2: Mark’s Everyday Sneakers

Mark, a recent college graduate, was looking for a reliable pair of sneakers for both work and casual outings. After an extensive search, he found a pair he loved for $120. Using BNPL, he spread his payments over three installments. This method allowed him to purchase the shoes immediately while managing his monthly expenses effectively. Mark was pleased to find that wearing stylish sneakers impacted his confidence positively during job interviews.

Comparison of Popular BNPL Services for Shoe Purchases

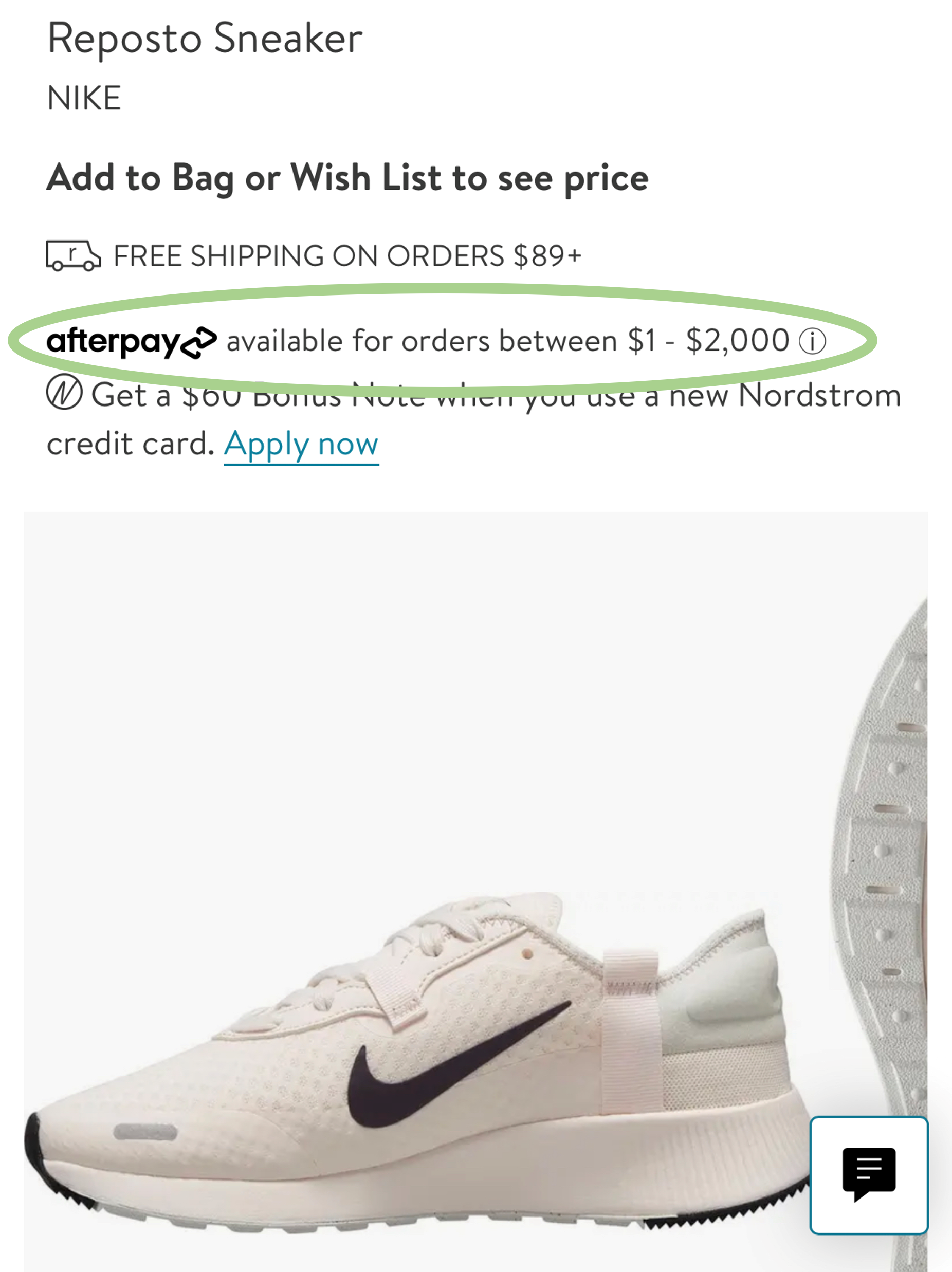

While there are several BNPL providers available, understanding the nuances of each can guide you in making the right choice. Below is a comparison table of some popular BNPL services in the U.S. footwear market.

| BNPL Service | Payment Structure | Late Fees | Interest Rates | Partnered Retailers |

|---|---|---|---|---|

| Klarna | 4 Payments Every 2 Weeks | Late Fees Apply | No Interest if Paid on Time | Lots, including major footwear brands |

| Afterpay | 4 Equal Payments Every 2 Weeks | $8 or 25% of Purchase | No Interest if Paid on Time | Popular fashion brands |

| Affirm | 3, 6, or 12 Months | Up to $25 | 5-30% Based on Credit | Wide array of retailers |

As you can see, each service has its pros and cons, and understanding these can help you select the best BNPL option for your footwear needs.

Pros and Cons of BNPL for Footwear Purchases

Before diving into the world of buy now pay later shoes, it’s essential to understand both the advantages and disadvantages of using this payment method.

Pros:

- Instant Gratification: Get your shoes right away without full upfront costs.

- Flexible Payment Options: Choose a payment plan that suits your budget.

- No Hidden Fees: Clear payment structure and terms, assuming timely payments.

- Improved Cash Flow: Maintain liquidity while shopping smart.

Cons:

- Potential Late Fees: Missing payments may incur additional charges.

- Encouragement of Impulse Buying: The ease of purchase might lead to overspending.

- Limited Credit Check: Not all BNPL services conduct thorough checks, which can lead to unaffordable debt.

- Interest Charges: If you opt for longer terms, interest rates may apply.

Tips for Smart Shopping with BNPL

To make the most of your BNPL experience when purchasing shoes online, consider the following tips:

1. Set a Budget

Know your financial limitations and set a budget before shopping. This way, you can avoid overspending and ensure you can make the required payments.

2. Read the Terms and Conditions

Before using BNPL, always read the detailed terms and conditions. Understanding what fees may apply, and payment schedules will help you avoid unexpected charges.

3. Choose Reputable Retailers

Only shop with retailers that you trust and that have a good reputation for customer service. Check reviews and ratings from past customers before making a purchase.

4. Keep Track of Payment Dates

Monitor your payment schedule closely to ensure you make payments on time. Setting reminders can help you stay organized.

5. Use BNPL for Essential Purchases

Consider using BNPL for necessary footwear rather than impulse buys. This ensures you’re getting value and not just leveraging a payment method for convenience.

Product Highlights: Best Shoes to Buy Now Pay Later

Here’s a look at some of the most popular footwear options that you can buy using BNPL schemes:

1. Nike Air Max Series

- Price: $150 – $220

- Style: Sneakers suitable for running and casual wear.

- Why they’re loved: Comfort and innovative design.

2. Adidas Ultraboost

- Price: $180 – $250

- Style: Running shoes that double up as fashionable sneakers.

- Why they’re loved: Ultimate comfort and stylish aesthetics.

3. Dr. Martens 1460 Boots

- Price: $150 – $200

- Style: Classic boots suitable for various outfits.

- Why they’re loved: Timeless style and durability.

Frequently Asked Questions (FAQs)

1. What are the eligibility requirements for BNPL services?

Most BNPL services require you to be at least 18 years old and a U.S. resident. Additionally, they may check your credit to determine eligibility.

2. Can I use BNPL for returns?

Yes, most BNPL services allow for returns. However, ensure to check the retailer’s return policy and how it affects your payment plan.

3. Is using BNPL safe?

Using reputable BNPL services is generally safe. However, always read the terms and conditions to ensure you understand any potential risks.

4. What happens if I miss a payment?

If you miss a payment, you may incur late fees and your account could be flagged, affecting your ability to use BNPL in the future.

5. Can I use BNPL for discounted shoes?

Yes! You can often use BNPL on sale items, giving you the opportunity to snag great deals while using flexible payment options.

6. Are there interest charges with BNPL?

Interest charges depend on the service and your payment plan. Some services offer no interest if you pay within a specified timeframe, while others may charge interest for longer payment plans.

7. How does BNPL impact my credit score?

Generally, using BNPL won’t affect your credit score unless you miss payments. However, some providers might run a soft credit check, which can be noted on your report.

8. Can I use BNPL for international shipping?

Most BNPL services are limited to the U.S. for purchases. Check with the retailer and BNPL provider for international shipping options.

9. Will BNPL work for every shoe brand?

No, not every retailer or shoe brand offers BNPL options. Always check at checkout to see if this payment method is available for your selected footwear.

Conclusion: Step Into the Future of Footwear Shopping

The buy now pay later model adds a refreshing layer of flexibility to shoe shopping online. By allowing you to enjoy immediate access to your favorite styles while managing your budget, BNPL is reshaping how consumers approach their footwear purchases. As you navigate through the advantages and considerations of using BNPL, remember to shop responsibly. Whether you’re a casual buyer or a fashion aficionado, this payment solution can enhance your shopping experience.

So, why wait? Explore your favorite footwear options today and take advantage of BNPL services to elevate your style without breaking the bank!

For further reading on financing options and shopping trends, check out this study by the National Institutes of Health and the Consumer Financial Protection Bureau’s report on credit in the U.S.